The UK construction industry operates differently from many other sectors when it comes to tax. With a high number of self-employed workers, subcontractors, and short-term projects, managing tax compliance has historically been challenging. To address this, the government introduced the Construction Industry Scheme, more commonly known as CIS.

If you are a contractor, subcontractor, sole trader, or limited company working within construction, understanding CIS is not optional. It directly affects how you are paid, how much tax is deducted from your income, and how you report your finances to HMRC.

This guide explains what CIS is, who it applies to, how it works in practice, and why proper CIS bookkeeping service is essential for staying compliant and protecting your cash flow. Whether you are new to the construction industry or have been working under CIS for years, this article will help you understand the scheme clearly and confidently.

Understanding the Construction Industry Scheme

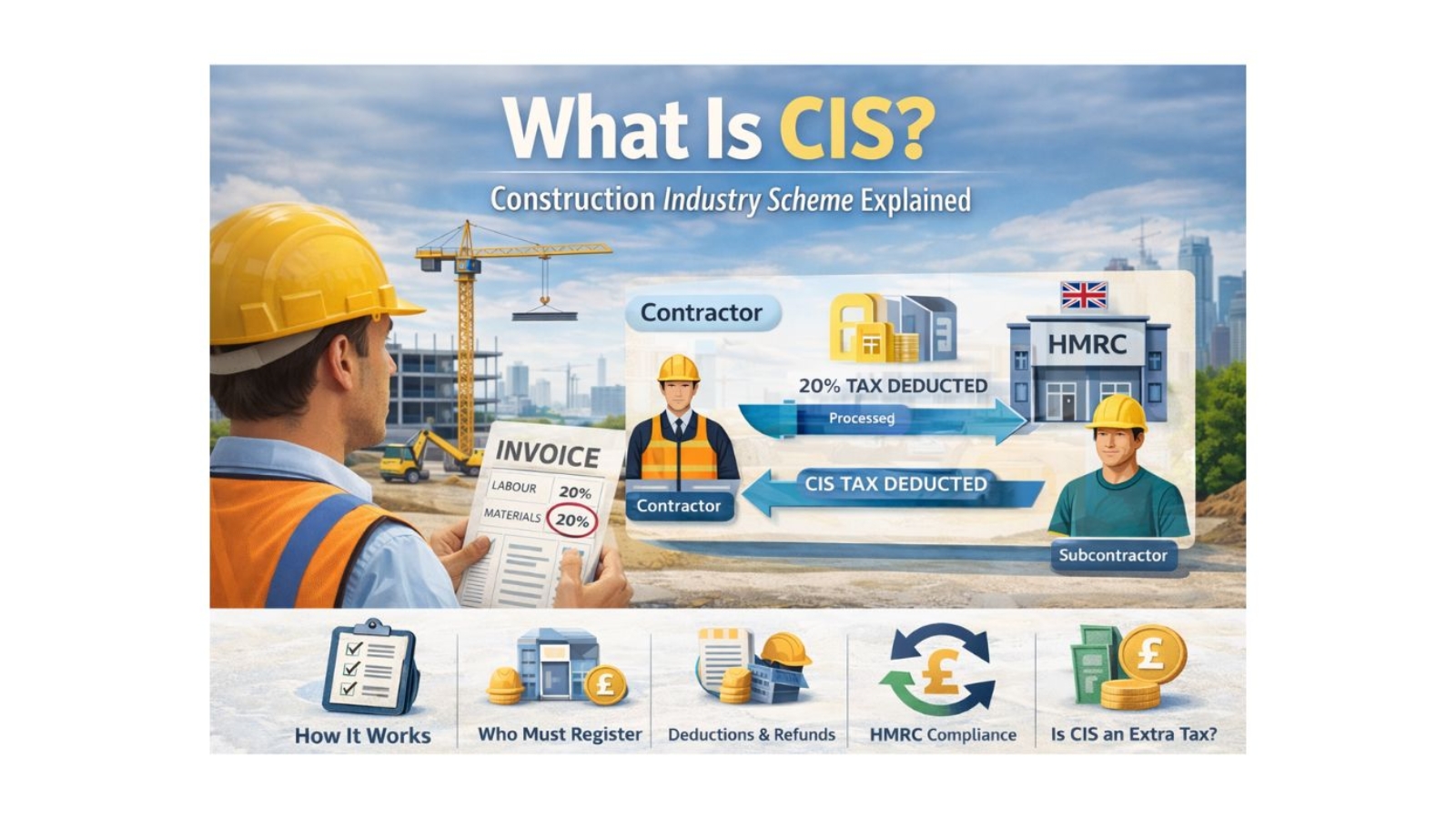

The Construction Industry Scheme is a tax deduction system specifically designed for the construction sector in the UK. Under CIS, contractors deduct tax from payments they make to subcontractors and pass those deductions directly to HMRC. The subcontractor then receives the remaining amount as their payment.

Unlike most other businesses where tax is paid annually through Self-Assessment or corporation tax, CIS ensures that tax is collected throughout the year as work is carried out. This helps HMRC reduce the risk of unpaid tax while spreading the tax burden more evenly for workers in the industry.

CIS is not an extra tax. It is simply a method of collecting income tax in advance. Any CIS deductions made during the year are offset against the subcontractor’s final tax bill when they submit their tax return.

Why CIS Exists and Why It Matters?

The construction industry has long relied on self-employed labour, temporary contracts, and subcontracting arrangements. While this flexibility benefits businesses, it historically made tax compliance more difficult to track. CIS was introduced to bring consistency, accountability, and transparency to construction payments.

For contractors, CIS creates a legal responsibility to deduct and report tax correctly. For subcontractors, it ensures that tax contributions are made regularly rather than building up into an unmanageable bill at the end of the year.

CIS matters because mistakes can be expensive. Incorrect deductions, late submissions, or failure to register can lead to penalties, overpaid tax, cash flow problems, and even HMRC compliance checks. Understanding the scheme properly is the first step toward avoiding these issues.

Who Does CIS Apply To?

CIS applies to most people and businesses involved in construction work in the UK. It affects both those who pay for construction work and those who are paid to carry it out.

Contractors are businesses that pay subcontractors for construction services. This includes traditional construction firms, developers, and even businesses whose main activity is not construction but who spend significant amounts on construction work each year.

Subcontractors are individuals or businesses that are paid by contractors to carry out construction work. Subcontractors can be sole traders, partnerships, or limited companies. Even if construction is not your main source of income, CIS may still apply if the work you do falls within the scheme.

It is also common for a business to be both a contractor and a subcontractor at the same time. For example, a building company may subcontract part of a project while also working as a subcontractor on another site.

What Counts as Construction Work Under CIS?

CIS covers a wide range of activities related to construction. This includes most work done on permanent or temporary buildings and structures, as well as civil engineering projects.

Construction work under CIS includes building, altering, repairing, extending, demolishing, or dismantling structures. Trades such as bricklaying, carpentry, plumbing, electrical work, plastering, roofing, painting and decorating are all covered. Site preparation, groundwork, demolition, and repairs are also included.

However, not all services connected to construction fall under CIS. Professional services such as architecture and surveying are excluded, as is the delivery of materials when no labour is involved. Understanding whether your work qualifies is essential, as applying CIS incorrectly can lead to compliance issues.

Contractors and Their Responsibilities Under CIS

If you are a contractor, CIS places several legal obligations on your business. You must register for CIS with HMRC before you start paying subcontractors. Once registered, you are responsible for verifying each subcontractor to confirm their tax status and deduction rate.

Each time you pay a subcontractor, you must calculate and deduct the correct amount of CIS tax. You must then submit a monthly CIS return to HMRC detailing all payments and deductions made during that period. Even if you have not paid any subcontractors in a given month, a nil return must still be submitted.

Contractors are also responsible for providing subcontractors with deduction statements, which show how much tax has been deducted. Failure to meet these responsibilities can result in fines and penalties, even if the subcontractor has paid their tax correctly.

Subcontractors and How CIS Affects Their Income

For subcontractors, CIS directly affects how much money you receive from each payment. Before you are paid, the contractor deducts CIS tax from the labour portion of your invoice and sends it to HMRC on your behalf.

The standard deduction rate for registered subcontractors is 20 percent. If you are not registered for CIS, the deduction increases to 30 percent, which can significantly impact your cash flow. Some subcontractors may qualify for Gross Payment Status, which allows them to be paid in full without deductions, although strict conditions apply.

It is important to understand that CIS deductions are not lost money. They count toward your income tax and National Insurance contributions. When you submit your Self Assessment tax return or company tax return, the deductions are offset against your total tax liability. In many cases, subcontractors are entitled to a CIS tax refund.

How to Register for CIS

Registering for CIS is one of the most important steps for anyone working in the construction industry. Contractors must register before paying subcontractors, while subcontractors should register as soon as they begin carrying out construction work.

Registration is completed directly with HMRC and requires basic business details such as your National Insurance number or company registration number, Unique Taxpayer Reference, and information about your business activities. Contractors must also register for PAYE before they can submit CIS returns.

Although the registration process is relatively straightforward, errors at this stage can cause ongoing problems. Incorrect details may result in subcontractors being verified incorrectly, higher deduction rates being applied, or CIS returns being rejected. For this reason, many construction businesses choose to seek professional support to ensure registration is completed accurately from the outset.

How CIS Tax Deductions Are Calculated

CIS deductions are applied only to the labour element of a subcontractor’s invoice. Costs for materials, VAT, and certain allowable expenses are excluded from the deduction calculation. This distinction is critical, yet it is one of the most common areas where errors occur.

For example, if a subcontractor invoices for both labour and materials, CIS tax should only be deducted from the labour amount. Deducting tax from materials is incorrect and results in overpaid tax, which can negatively impact cash flow.

Understanding how to separate labour and materials correctly is a key part of good CIS bookkeeping. Accurate invoicing and record-keeping ensure that deductions are calculated correctly and fairly.

Gross Payment Status Explained

Gross Payment Status allows eligible subcontractors to receive their payments without CIS deductions. While this can improve cash flow, it does not remove the obligation to pay tax. Subcontractors with Gross Payment Status must still submit tax returns and pay income tax or corporation tax as normal.

To qualify, a business must meet strict compliance and financial criteria, including submitting all tax returns on time and maintaining a good payment history with HMRC. Losing Gross Payment Status due to non-compliance can have serious financial consequences and often results in immediate deductions being reintroduced.

CIS and VAT: How They Interact

CIS and VAT are separate systems, but they often apply to the same transactions. CIS deductions are calculated before VAT is added to an invoice, while VAT is charged in the usual way.

In addition, many construction businesses are affected by the VAT Domestic Reverse Charge, which changes how VAT is accounted for on certain construction services. Managing CIS and VAT together requires careful bookkeeping and a clear understanding of the rules.

Errors in VAT and CIS reporting are a common trigger for HMRC compliance checks, making accurate financial management essential.

Monthly CIS Returns and Deadlines

Every month, contractors must submit a CIS return to HMRC detailing all payments made to subcontractors. This return confirms who was paid, how much was paid, and how much tax was deducted.

Returns must be submitted by the 19th of each month. Late submissions result in automatic penalties, even if no tax is owed. Repeated late filing can lead to escalating fines and increased scrutiny from HMRC.

Consistent, timely submissions are a key part of maintaining CIS compliance.

What Happens If You Get CIS Wrong?

HMRC takes CIS compliance seriously, and errors can lead to financial penalties and compliance checks. Common issues include failing to verify subcontractors, applying incorrect deduction rates, submitting late or inaccurate returns, and poor record-keeping.

Penalties can be applied even where no tax is due, particularly for late submissions. In more serious cases, HMRC may carry out a detailed compliance review of your business. Keeping accurate records and managing CIS correctly significantly reduces the risk of enforcement action.

Record-Keeping Under CIS

CIS requires detailed and accurate record-keeping. Contractors and subcontractors must keep records of invoices, payments, deductions, verification details, and deduction statements.

These records must be retained for at least three years and must be available if HMRC requests them. Poor record-keeping not only makes compliance more difficult but also increases the risk of penalties and lost tax refunds.

Professional bookkeeping ensures that records are complete, accurate, and easy to access when needed.

Claiming CIS Tax Refunds

Many subcontractors are entitled to CIS tax refunds, particularly if their deductions exceed their actual tax liability. Refunds are claimed through Self Assessment for sole traders or through the company tax process for limited companies.

Without proper bookkeeping, refunds can be delayed or missed entirely. Accurate records and timely tax returns are essential for recovering overpaid CIS tax.

Common CIS Mistakes and How to Avoid Them

CIS mistakes are often caused by misunderstanding the rules or attempting to manage everything without professional support. Common errors include failing to register, applying the wrong deduction rate, deducting tax from materials, missing monthly returns, and poor record-keeping.

These mistakes can result in penalties, cash flow issues, and unnecessary stress. Avoiding them starts with understanding CIS properly and seeking expert help when needed.

The Importance of Professional CIS Bookkeeping

CIS is one of the most complex areas of UK bookkeeping for small businesses. Managing registrations, deductions, returns, VAT, and refunds requires accuracy and consistency.

Professional CIS bookkeeping helps ensure that everything is handled correctly, saving time and reducing risk. It also provides peace of mind, allowing construction professionals to focus on their work rather than worrying about compliance.

For businesses operating under CIS, expert support is not a luxury; it is a practical investment.

How CIS Impacts Cash Flow for Construction Businesses

Cash flow is one of the biggest challenges in the construction industry, particularly for subcontractors working under CIS. Because tax is deducted at source, the amount received in your bank account is often significantly less than the value of the invoice you submit.

Without a clear understanding of CIS deductions, it is easy to underestimate the impact on day-to-day finances. Materials, fuel, tools, insurance, and other running costs still need to be paid in full, even though part of your income has already been deducted for tax.

Proper CIS bookkeeping allows you to track deductions in real time, understand your true take-home income, and plan for upcoming expenses. It also ensures that overpaid tax is identified early so refunds can be claimed as soon as possible.

CIS and Self-Assessment: What You Need to Know

For self-employed subcontractors, CIS and Self-Assessment go hand in hand. Even though tax is deducted under CIS, you are still required to submit a Self-Assessment tax return each year.

Many subcontractors mistakenly believe that CIS deductions remove the need for a tax return. Failing to submit a return can lead to penalties, missed refunds, and compliance issues with HMRC. CIS deductions are simply credited against your final tax bill.

CIS for Limited Companies: How It Works in Practice

CIS also applies to limited companies working in construction, but the way deductions are reclaimed is slightly different. When a limited company has CIS tax deducted, these deductions can be offset against PAYE liabilities and corporation tax.

This process requires careful bookkeeping and accurate reporting, as errors can delay reclaims and affect cash flow. Managing CIS alongside payroll and VAT obligations often requires professional support.

Frequently Asked Questions About CIS (Construction Industry Scheme)

What does CIS stand for in construction?

CIS stands for the Construction Industry Scheme. It is a UK tax scheme that applies specifically to construction work and determines how tax is deducted from payments made to subcontractors. Under CIS, contractors deduct tax from labour costs and pass it to HMRC on the subcontractor’s behalf. These deductions are then offset against the subcontractor’s final tax bill.

Who needs to register for CIS?

Anyone who pays subcontractors for construction work must register as a contractor under CIS. Subcontractors should also register so they are taxed at the standard 20% rate rather than the higher 30% rate applied to unregistered workers. Even if construction is not your main business, CIS registration may still be required if you regularly pay for construction services.

Is CIS an additional tax? No, CIS is not an extra tax. It is a method of collecting income tax in advance. The deductions made under CIS count toward your income tax and National Insurance contributions. When you submit your Self-Assessment tax return or company tax return, CIS deductions are considered, and you may even be entitled to a refund if you have overpaid.

How much tax is deducted under CIS?

The amount deducted depends on your registration status. Registered subcontractors usually have 20% deducted from their labour costs. Unregistered subcontractors are charged at 30%. Some subcontractors qualify for Gross Payment Status, which allows them to be paid in full without deductions, although tax is still payable later through normal tax returns.

Do CIS deductions apply to materials?

No, CIS deductions apply only to labour costs. Materials, VAT, and certain allowable expenses should not be included when calculating CIS tax. Incorrectly deducting tax from materials is a common mistake and can result in overpaid tax and cash flow problems for subcontractors.

Do I still need to file a tax return if I’m on CIS?

Yes. CIS does not replace the need to submit a tax return. Sole traders must still file a Self-Assessment tax return, and limited companies must submit corporation tax returns and payroll reports where applicable. CIS deductions are simply included as part of your overall tax calculation.

Can I claim a CIS tax refund?

Yes, many subcontractors are eligible for a CIS tax refund, particularly if their deductions exceed their actual tax liability. Refunds are usually claimed after submitting a tax return. Accurate bookkeeping is essential to ensure all CIS deductions are recorded correctly so refunds are not delayed or missed.

What happens if I don’t register for CIS?

If you do not register as a subcontractor, contractors are required to deduct tax at the higher 30% rate. This can significantly reduce your take-home pay and negatively affect cash flow. Contractors who fail to register or comply with CIS rules may also face penalties and fines.

Can a business be both a contractor and a subcontractor?

Yes, this is very common in the construction industry. A business may act as a contractor on one project while working as a subcontractor on another. In these cases, CIS responsibilities apply in both directions, which makes accurate bookkeeping even more important.

How long should CIS records be kept?

CIS records should be kept for at least three years. These include invoices, payment records, CIS deduction statements, subcontractor verification details, and proof of materials costs. Keeping clear and organised records helps ensure compliance and makes dealing with HMRC much easier if questions arise.

Final Thoughts

The Construction Industry Scheme plays a crucial role in how tax is managed within the UK construction sector. While it can seem complex at first, understanding how CIS works is essential for protecting your income, maintaining compliance, and avoiding costly mistakes.

With the right knowledge and professional support, CIS becomes a manageable part of running a construction business rather than a source of confusion or risk.

Need Help with CIS Bookkeeping?

Managing the Construction Industry Scheme correctly is essential, but it can also be time-consuming and confusing especially when you’re trying to focus on running your construction business.

At Carter Bookkeeping Services Limited, we support contractors and subcontractors across the UK with accurate, reliable CIS bookkeeping. From registrations and verifications to monthly returns, VAT, and CIS tax refunds, we ensure everything is handled correctly and on time.

👉 Contact Carter Bookkeeping Services Limited today and take the stress out of CIS.

Add a Comment